Are you a cute short guy who wants to find the perfect name for your newly-adopted pet? Or maybe you’re just looking for a unique pet name that will catch their attention? If your answer is yes, then we have something in common. Too often, names are given to pets without knowing what personality they …

100 Welsh Boy Names

Welsh names are the rarest in Britain and Ireland, a result of being one of the last Celtic groups to adopt Christianity. There are many variations among Welsh names, which can have both male and female parts, with some surnames such as Thomas not being found among Welsh people. The patronyms are also quite diverse, …

100 Beautiful And Lovely Names For Greek Girls

There is a common trend for celebrities who choose to name their daughter after one of the many great ancient Greek and Roman female figures, including names such as Aphrodite, Homer, Athena, and Cleopatra. Nowadays, this is becoming more and more popular among parents whose children are born in the 21st century.

100 Baby Names That Mean Moon

The names of people and children have been around the world since time immemorial. It is challenging to have a baby without knowing what to name it, as there are so many options! One of the things that can be tricky is trying to find a unique name while sticking to your cultural tradition. This …

Top 100 Great Anime Boy Names With Meaning

When parents are considering what name their son should have, they may be uncertain of which to choose. This can make picking an appropriate name hard, but it’s easier to decide by understanding the meaning of the name. Many names in anime come with a specific story and meaning behind them. We’ve compiled this list …

100 Norwegian Boy Names For Your Little Prince

The origin of Norwegian names lies in the Vikings and Norse mythology. Norway is a mountainous nation renowned for its extensive forests and salmon-filled fjords. Norwegian, a Germanic language descended from Old Norse, is spoken by five million people worldwide.

Aurora Name Meaning

Prior to everything else, we can all agree that having a suitable name is crucial in life. It is the means by which we are identified on a daily basis. Even if there is no assurance that a child will live up to the spirit and meaning of their name, it cannot be denied that …

Top 100 Popular Victorian Girl Names

A girl will always carry her name with her throughout her life, so it’s so important to choose a fitting name. The Victorian era was one of social hierarchy and class distinction, and girls’ names reflected this sentiment. This list of 100 female victorian names and their meanings will help you find the perfect monicker …

100 Popular Last Names As First Names

If you’re not sure what to name your child, there’s always the option of giving their last name as a first name. It might sound “old-fashioned,” but it’s gaining momentum thanks to celebrities like John Legend and Priyanka Chopra. Here are the 100 most popular last names as first names if you’re curious.

100 Popular Turkish Girl Names And Meanings

Turkey might be located in Eastern Europe, but that doesn’t mean that Turkish parents are sticking to European names. As you’ll see from the list below, many Turkish parents choose Arabic and Islamic origin names for their children. As always on Familypedia, we have compiled a list of 100 Popular Turkish Girl Names and their …

Top 100 Classic Gaelic Girl Names And Meanings

The Gaelic people who live in Scotland and Ireland have kept many of the old Celtic traditions and myths alive. Over time, the language spoken by these people has changed considerably. The Scottish Gaelic is different from the Irish Gaelic; just as diverse are the names given to girls during their birth.

Top 100 Scottish Boy Names And Meaning

Are you looking for a unique name for your baby boy? While most parents research popular names worldwide, Scottish baby names can offer a fresh and unique selection. Names from Scotland have been passed down through generations and are often rooted in Gaelic or Scottish culture. This post will provide 100 Scottish boy names and …

Gabrielle Name Meaning

What is your name? Do you know what it means? Chances are, this question intrigues you, and your answer is no. What does your name mean, and how did it get its meaning? Find out about the origin of your or a loved one’s name with this blog post! Every name has a story. Yours …

Benjamin Name Meaning

Depending on the culture, names can have meanings that vary from country to country. People in ancient Greece named their children after gods; scientists in China call their discoveries by Latin nomenclature like “Nebula”. In Native American cultures, the names often reflect their religious beliefs and mythology but still make sense linguistically.

Avery Name Meaning

The meaning of a person’s name is one of the essential components of their identity, and vice versa: a person’s name is one of the most important aspects of their identity. The meaning of your name can be a reflection not only on you and what you stand for but can also have a significant …

Lilith Name Meaning

Many parents have confided in me in hushed tones about their feelings of embarrassment and remorse regarding the names they chose for their children. Some parents are easily swayed by popular trends, and they quickly come to the conclusion that the name they chose for their child was incorrect after writing it on the birth …

Top 100 Turkish Boy Names And Meanings

Turkish is the official language of Turkey, so it’s no surprise that there are a lot of Turkish names out there. Common Turkish male names include Erkan, Cahit, Cengiz, and Huseyin. The following list includes 100 popular or notable boy names and their meanings.

100 Hebrew Girl Names

Gender-based names have become somewhat of an issue in the United States. Parents have started naming their girls something other than traditionally feminine names, such as John and Zakary. In contrast, others have reversed the trend by giving their boys traditional female names like Michael or Adam. These trends seem to be continuing with Hebrew-girl-names. …

100 Evil And Demon Baby Names

If you don’t think finding the perfect name for a sweet baby is hard enough, try picking one out for an evil demon that will come to Earth with nothing but vengeance in its cold, black heart.

100 Hawaiian Girl Names

In old Hawaii, naming a newborn child was accomplished in two stages. The first stage, called pa’i nana wale (to think about the name), began when the expectant mother was still in utero and lasted one month after birth. The second stage, named kapu ka’ai makuahine (to give a name), begins as soon as the …

100 Irish Girl Names

Many parents search for Irish girl names to give their child an edge in life. But this is not always the case; some girls may be named after places and things, rather than simply old hag women or Irish saints, because they are popular. People tend to use Irish girl names as they like them …

Silas Name Meaning

A name is a one-of-a-kind and personalized present. The power of a name is that it can be given once, but not twice. A name contains within it not just who you are but also what you were hoping to accomplish, the legacy you leave behind. This is a guide to finding the real meaning …

Daniel Name Meaning

Names often come with a variety of meanings that are rooted in various cultures and beliefs, connecting them as part of our heritage even if we aren’t sure what those particular associations mean for us personally. A name can be a family tradition meaning something special about that person’s life. It is possible to find …

100 Adorable And Unique Baby Space Names

Space is vast and incredibly beautiful. In space, we can see how small our planet is compared to the rest of the universe. The sun is so far from this earth that it appears like a tiny star rotating around our planet. Beyond Earth, there are so many other stars that it sometimes feels like …

100 Names That Mean Wind Sky Storm

The world is an infinitely vast place, and there are countless numbers of words that can be used to describe the feelings, sensations, and images these things evoke. Some of these words have been around for centuries, whereas others have only existed for a few decades. But no matter how long a word has been …

100 Exotic Girl Names

No one ever has the perfect name for their baby girl. We’ve all been there. Maybe you have a long list of names you like but can’t find just the right fit. Maybe your name is on point, and you want to try something different maybe something exotic to honour your roots or make her …

100 Arabic Girl Names

Arabic names have a significant meaning and powerful history. If you’re looking for a new name, maybe one that’s not just a regular girl’s name, try something like Amal, Zahra, or Irini. These names have a unique vibe, and they all have interesting meanings. Check out this list of great Arabic names for girls and …

100 John Name and Meaning

If John’s name isn’t right for your little one, you might want to consider some other names with similar meanings. Some popular choices include James, which means “supplanter,” and Kevin, “handsome.” However, if your favorite meaning for John is different from those mentioned above, it may work just as well for you.

100 Greek Boy Names

You might think that the names of Greek children are not different from those in many other places in the world, but you would be mistaken. The naming practices of Greece, since ancient times, have been distinctive and influenced by a variety of factors. More traditional families will often give their children two names: one …

100 Fantasy And Scifi Baby Names

Many people identify as fans of science fiction and fantasy genres. In some cases, this can lead to having children based on the franchise’s universe or characters. But what if you don’t want your son or daughter named after a character from Game of Thrones, Back to the Future, or Black Beauty? A list of …

100 Warlock, Wizard, Witch Baby Names

There are many baby names, but these two particular words are not among them. It is impossible to refer to a person who refers to themselves as a warlock, wizard, or witch without immediately thinking of the child they may have had with their “soul mate”. The word has no direct English translation, and the …

100 Brazilian Boy Names

Our list of Brazilian baby boy names is the most comprehensive we could come up with! This list included over 500 names and was created by an expert. We hope you enjoy this article so you can find the perfect name for your little boy.

10 Best Doctor Kit Toys Of 2022 For Your Little Doctor

Like a good little doctor, your child will never be late to come in and give you a hug and a kiss goodbye to your illness, even if you pretend that you have caught a fever or that you have been suffering from a tummy pain. If you have a small child that enjoys playing …

10 Best Doctor Kit Toys Of 2022 For Your Little DoctorRead More

40 Greatest Baby Clothes Brands Of 2022

As a parent, you’ll become well acquainted with the baby clothing market. So which brands are worth your time? Parents today have more choices than ever when it comes to buying clothes for babies and kids. But if you’re looking for a personalized recommendation based on what’s hot in fashion and what actually lasts through …

100 Fire Related Baby Names

Recently, many babies born in the United States share their names with a fire-related event. For example, there are now more than 1,000 baby girls named “Maria” (Spanish for “fire”) in the United States. To help combat this issue, a list of 100 entries was compiled from baby names that represent fires from around the …

100 Pacific Islander Baby Names

Babies born in this part of the world don’t typically have last names or surnames. It is likely that you will end up using a first and last name names typically associated with Western customs. On top of that, these are very specific cultures, so many last names have meanings and roots in language, history, …

100 Short Girl Names

There are hundreds of adorable girl names to choose from, but not all of them can fit on a t-shirt. No matter what your height is or how quirky you are, there’s got to be a name that suits you. We’ve put together this list to help you find the perfect name for your little …

100 Norwegian Girl Names

There are so many strong, tough, and incredibly beautiful Norwegian girl names to choose from! Did you know that many of the Scandinavian country’s first names were borrowed from German and English? Or how about that the language itself stems from Old Norse, a dialect of Old West Norse?

99 Brazilian Girl Names

There are many Brazilian girl names that have their origin in Portuguese, such as Graziela or Lívia. I’ve found that the best way to find a name is to check out the top 10 most popular names for girls in Brazil, as well as read a baby name book. It’s important to find a name …

100 Badass Baby Names

Badass baby names are a growing trend and follow the logic of “more unique, more badass”. The idea is that a name like Noah or Sophie doesn’t make them seem tough enough, so parents are using names like Armani and Bijou. The trend began in 2007 with the births of Jackson, Kai, and Skye. Just …

101 Native American Girl Names

This blog post will be about the most popular girl names for Native American heritage. There are a variety of different origins and meanings behind these names, but most importantly they’re beautiful! Any girl name with Native American heritage has to be included if you want to create a great little doll for your newborn.

100 Fabulous Hispanic Girl Names

If you are looking for names right off the bat, we have provided you with 100 Hispanic girl names complete with their meanings. We hope that these will suit your expectations and give you a starting point in finding the perfect name for your daughter! Here is a list of some neat, beautiful, or powerful …

99 Unique Hispanic Names For Boys

I have been compiling a list of names for my son and realized that there are not many Hispanic ones. I started looking, and found some here and there, but not very many. So I decided to compile a list of 100 names who are interested in a Hispanic name for their son. These names …

99 Adorable and Lovely African Names for Girl

Some people believe that the world has turned upside down, and they’re convinced that something’s wrong. While it’s true that our society is changing in some ways, there are also some things that never change like the names of little girls. This blog post will be your guide to finding 100 African girl names that …

105 Old Fashioned Girl Names

The name you give your child is likely to be with her forever. So, it’s important to find one that’s timeless and suitable for every situation she may face in life. Now there are new ways to find the perfect name for your little one, but before you do that, make sure you better understand …

100 Ava Name Meaning

The meaning of Ava name means new and unmet. This name use in Spanish, Polish and Hebrew countries. The name Ava is also used as a girl’s name in Brazilian, Italian and English cultures. This name was popular during the Middle Ages. Ava word is related to the Saxon-Germanic word “eva” which means life or …

Top 100 Ezra Name Meaning

Ezra is a Hebrew name that means “help.” It is derived from the word עזר, meaning “help” or “support.” This name was popularized in the Bible by Ezra, a priest who collected the scriptures and led people to believe in God. It is also the name of one of Jesus’ disciples. At last count, Ezra …

100 Elijah Name Meaning

A name that means “Yahweh is God,” Elijah is a Hebrew name. Because of the meaning of this name, some parents use it for their child in order to try and draw closer to God. Others have it as a middle or last name because they believe the power of this word will help them …

Kai Name Meaning

It’s also interesting to note that the meaning of Kai can vary greatly depending on the origin of a person’s Kai name. If you’re searching for an attractive and meaningful name, try thinking about how your new role in life will overlap with this character that you would like to embody and move towards matching …

Maeve Name Meaning (The Intoxicating One)

If you are considering giving your baby Maeve as their name, the meaning of the name must be an important factor in your decision. Find out what it means to be the namesake of this Irish goddess.

100 Indian Girl Names

Indian culture is one of the oldest in the world. You can learn about the culture and their language from this article. Here you can find some of the most common as well as uncommon Indian girl names. It also features some of the origins and meanings for these different names.

100 Welsh Girl Names

Do you know what to do when you find a Welsh girl name you like? Would you like to name your new daughter something exotic, different, and unique? If so, then this list of Welsh names is for you. This list of Welsh girl names should provide all the inspiration and options you could ever …

100 Hebrew Boy Names For Your Little One

Israeli Hebrew is an old Semitic language. It gradually fell out of use between 200 and 400 CE but lingered quietly in Jewish liturgy and literature. It is fascinating to note that near the close of the nineteenth century, the Hebrew language had a complete renaissance, becoming the very only first language to experience such …

100 Elegant Girl Names For Your Little Lady

Names are the essential aspect of an individual’s identity. It is the initial facet of a person’s personality. A person’s name has a vital role in how others perceive them. Therefore, it is vital to offer careful consideration when naming our children, particularly our baby girls.

100 Baby Names That Mean Winter, Ice, And Snow

Winter is accompanied by both the pleasure of snowfall and the comfort of a fireplace. What is the ideal name for your child that evokes affectionate warmth and coziness? The cold of winter can be debilitating, but it is also a season for cuddling, skiing, and spending quality time with family and friends.

100 Sweet Swedish Girl Names For Your Princess

Sweden has a rich and fascinating history, as evidenced by its lush, green woods, spectacular vistas of the northern lights, lingonberries, Swedish meatballs, and the pop group ABBA. Due to the enormous migration that occurred more than a century ago, more than 9 million Americans today claim Scandinavian heritage. This represents around 3 percent of …

Top 100 African Boy Names And Meaning

The name is a crucial factor in determining the success and development of a child. The great importance placed on the character opens up many opportunities for parents to select their child’s name according to their personality and qualities. African terms are usually defined by place, event, or meaning. This post will provide 100 baby …

Top 100 Cute Baby Girl Names And Meaning

Looking for a unique baby girl name? Check out this exciting list of sweet, short, and pretty words. Some of these are popular, so don’t miss out on your chance to choose a funky moniker for your precious little bundle of joy. This post will provide 100 of the cutest and most adorable names for …

Top 100 Sexy Boy Names And Meaning

The birth of a child is a significant event for many people. With that, the mother often goes through picking out baby names. It’s common to find the top 100 popular boy names in the US, but nobody told us how they were ranked! Why? We’ve created this list of some famous and most beautiful …

Liam Name Meaning (Strong – Willed Warrior)

There are so many names that have come and gone throughout the centuries, and in recent times there has been a huge influx of names from all over the world. But why? The name Liam was originally borne out of Ireland but has now become one of the most popular baby boy names in America …

100 Earthy Nature-Inspired Baby Names

Do you fantasize about family camping excursions and weekend hikes? If you have a deep respect for the natural world and feel that this is something you would like to pass on to your new child, why not start by naming your child after anything from the natural world?

100 Distinctly Gaelic Boy Names

It is not surprising that Gaelic boy names have endured. If you’re a history buff, you’ve likely considered Gaelic baby boy names for your unborn child. Gaelic is an old language with Irish origins. During the 1700s, it nearly became extinct due to a ban by the British government. Thankfully, it prevailed, bringing with it …

100 Magical Baby Names For Your Little Angel

Magical names have the ability to affect and motivate the individuals who bear them. Due to the coronavirus pandemic, their popularity has recently increased. After enduring extreme adversity, parents choose names with magical properties to arm and shield their children against future obstacles.

100 David Name Meaning

David is the English and German name of a popular character in the Old Testament. David was an Israelite monarch and one of the ancestors of Jesus Christ, as told in the Gospels according to Matthew, Mark, and Luke. The meaning behind his name reflects both his humble beginnings as a shepherd boy who killed …

100 Slavic Boy Names

Slavic names are filled with unique sounds and meanings. Whether you’re looking for a baby boy name or a nickname for your son, we’ve got a list of the best Slavic names. With such a wide array of names, it can be hard to pick the one that’s just right for your family. You may …

Top 100 India Boy Names

One of the most common questions we were asked on my India travel blog was about what Indian boy names were trending. So, for all you parents out there who are looking to name your baby (future) son, here are some of the most popular names in India today.

100 Swedish Boy Names

This blog post features a list of some of the most popular boy names in Sweden with interesting origins. We love this list because it gives me some insight into how people in other cultures choose the names for their kids. In addition, the list includes those Swedish boys that were chosen to play Harry …

Below Is What You’Re Doing When Your Infant Has Hiccups

If your baby suffers from hiccups, it might seem like an agonizing ordeal. So you go to a doctor or try honey and lemon to see if that will help, but nothing seems to work. That’s why you should consider trying these tips on how to get rid of baby hiccups. They are as easy …

Below Is What You’Re Doing When Your Infant Has HiccupsRead More

Polish Girl Names: 20 Lovely Names

As a Polish girl, it can feel like the possibilities are endless when it comes to selecting a first name, but this is really not the case. Polish names have certain characteristics that make them distinct from other cultures. And while there are many different pronunciations of certain names, they all adhere to one or …

100 French Boy Names For Your Monsieur

Have you been considering lovely and melodious French names for your son? You’ve come to the perfect place if you have French ancestry or are looking for a boy’s name with a French flair.

100 Greek Mythology Baby Names

If you are interested in ancient writings, mythological stories, culture, and a rich past, and you are seeking a rich and significant name for your child, Greek God baby names are a good choice. Greek god names are powerful, significant, rich, and uncommon. They are historical, with a captivating vibe and philosophical value. Deities, heroes, …

100 Slavic Girl Names

A name can be a baby’s first gift from parents. It carries echoes of the past and images of the future, and its sound is what welcomes a person into this world to become something new. However, there is nothing more difficult than choosing a name for your newborn at the beginning of their life.

100 Michael Name Meaning

Michael is a very common name, ranking in the top 100 names for males. The name Michael means “One who is like God”. It’s an ancient Greek word that means “Who is like God?” or “He who sees godly things.” A man by this name could have a strong sense of right and wrong or …

92 Arabic Boy Names

You are looking for Arabic boy names. You want to know the most popular Arabic boy names, and you want some guidance on picking out a couple of different options. Here is a list of the top 100 most popular Arabic boy names! This can give you an idea of what might be fun to …

100 Chinese Girl Names

Many people have to learn how to pronounce some of the names that sound very different in Chinese than in English. Others may be curious about what meaning these names have or who inspired their name. A list of popular girls’ names in China can help you decide what your baby will call herself (or …

100 Native American Boy Names

Native-American boy names vary wildly, with new ones becoming popular each year. Native-American girl names are a bit more uniform, with just a few appearing on the list each year and many of them being variations of the same name. The following table provides an overview of all the names that seem in demand amongst …

99 Old Fashioned Boy Names

You might be surprised at how many old-fashioned boy names are still popular today. To jog your memory of the classics, here are some classic boy names from recent decades. These boy names are tried and true and have stood the test of time. Whether you are looking for a name that stands out or …

100 Mexican Baby Names

What’s in a name? For all we know, your Mexican baby’s name could be the most important thing you’ll ever do for him or her. A proper Mexican name can help them grow up to be wise, skilled, and powerful people. If you want to know why, read on and learn what makes a good …

100 Teddy Bear Names

If you’re struggling to find the perfect name for your new teddy bear, don’t fret! There are a bunch of great ideas out there. Bear names like Mr. Bear, Stinky, and Nelly can be a little tricky if your teddy bear’s going to live in your bedroom or bedtime stories are part of her routine.

100 French Girl Names

This is a list of the most popular names for females in France. The list of French girls’ names was compiled from information from the social security office in France. The list is only made up of female names, so if you’re looking for a male name, you’ll just have to find your own!

100 Ethereal Elvish Baby Names

It’s the most wonderful time of the year! And if you’re expecting a baby during this joyous holiday season, there’s no better time to think about how to give them a festive name. We’ve compiled a list of elf names for the baby, with suggestions such as Pippin, Frodo, and Gandalf.

100 Victorian Boy Names

I recently discovered a new trend making its way back into the US: the next generation of baby boy names is taking on a Victorian flavor. Read on to see if these names are for you. Over the past decade or two, parents have abandoned traditional boy names like William and James for more modern …

100 Biblical Girl Names For Your Sweet Angel

When we consider the Bible, we see knowledgeable and heroic individuals who were valiant leaders of their people and devoted servants of God. But there were several biblical women who possessed equal or even greater power, courage, and wisdom and whose acts and words changed history. Although biblical girl names are less common than biblical …

100 Biblical Boy Names For Your Little Angel

In Biblical times, a person’s name frequently reflected his or her character or reputation. Names were picked to reflect the child’s personality or the parents’ hopes and goals for him or her. Frequently, the meanings of Hebrew names were easily understood and recognizable. Old Testament prophets frequently gave their offspring names that were indicative of …

100 Sweet And Poetic Korean Girl Names

Choosing an uncommon, beautiful, and popular Korean name for your girl can be challenging because there are so many options. If you’d like to give your daughter a Korean name but don’t know where to begin, you’ve come to the correct place. We’ve meticulously studied Korean female names, their meanings, and additional information about each …

Top 101 Strong Baby Girl Names And Meaning

The baby name list is below for parents looking for a strong, beautiful, or clever girl’s name. Sometimes it’s hard to find a suitable baby name, but we’ve got the best words here that are beautiful and strong. These 101 girl names will provide you with plenty of inspiration.

101 Cute Irish Boy Names With Meaning

Looking for a new name for your Irish baby boy? Maybe you are looking for some inspiration and just want to know all your options, or perhaps you have already found the perfect name and just need some ideas on spelling it. The Irish boy name list contains words that have meaning behind them, such …

100 Sweet Baby Flower Names For Girls And Boy

Your baby will be the sweetest flower. Lucky for you, we’ve compiled a list of the 100 most adorable, perfect names to give your new bundle of joy. Take your pick from our long list, whether you’re looking for a name that sounds masculine or feminine or one with a lot of meaning behind it.

Top 100 Great Hawaiian Boy Names With Meaning

A Hawaiian name can be a window into the past and a different culture and a powerful piece of the Hawaiian language. Not to mention it can add to your baby’s unique personality! The more you know about these terms, the more you’ll love your child’s name! If you’re looking for a Hawaiian name for …

101 Special Exotic Boy Names And Meaning

You have just found something very interesting, this is the page of 101 exotic boy names which will allow you to select that perfect name for your son. Look no further! Here you’ll find 101 of the best exotic, uncommon and rare boy names from all around the world.

100 Strong Baby Boy Names For Your Future Superhero

It is quite a challenge to pick the ideal name for your child. Being blessed with a baby boy is a joyous occasion, but naming your child can be challenging. Because you desire nothing but the best for your adorable baby boy, the pressure is enormous. With so many baby names and references available on …

100 Strong Baby Boy Names For Your Future SuperheroRead More

40 Baby Names That Sound Geeky and Nerdy

If you are a geek, nerd, a super fan, or anything close to that then this guide is for you. It is not as daunting as it sounds when you think about all of the incredible baby names out there. The choices are endless and I have listed some of my favorites for your perusal! …

101 Water Baby Names

Carrying on the trend of naming babies after vitamins, herbs, and foodstuffs that are good for them, parents are now being encouraged to consider names like Vagabond Darling, Maison Margiela, and Tremont. While these names may sound out of this world, they’re pretty tame compared to others. Our world has become more conscious of the …

100 Sexy Girl Names

If you’re a woman looking for a good name for your child or simply thinking of changing it to something more unique, then this is the blog post for you. You’ll find all the old-fashioned names and lots of nicknames for girls that have a badass edge. If you’re having trouble coming up with a …

100 Cute Baby Boy Names

Boys grow up so fast. Easier said than done if you find it hard to come up with creative and unique names for them. In this post, we have rounded up over 50 of the cutest baby boy names to give you more options! This includes a variety of themes, such as Arabic, American Indian, …

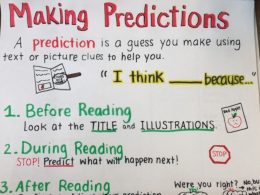

33 Incredible Anchor Charts For The 5th Grade

An anchor chart is a teaching tool. While teaching a class, you and your students collaborate to construct a chart that summarizes the most critical content and tactics. By making thinking visible both the teacher’s and students’ anchor charts foster a culture of literacy in the classroom.

40 Interesting Interactive Bulletin Boards For Students Of All Grades

Bulletin boards are an excellent method of disseminating critical information. Teachers use bulletin board space to display academic materials, student learning tools, and bulletins and calendars to keep parents informed of classroom activities. Interactive bulletin boards can be used for much more than that! Create an engaging environment for your pupils to motivate them to …

40 Interesting Interactive Bulletin Boards For Students Of All GradesRead More

100 Sun Names For Baby

The sun has been commonplace to the human race for centuries and has been an obsession of many cultures. Giving your child the name after the sun is a popular one that has seen a recent growth in use. This article will highlight some more familiar names deriving from the sun and how they are …

100 Italian Baby Boy Names

If you’re from Italy, congratulations on your gender reveal! Traditional gender roles and stereotypes have been replaced by the 21st century. Today’s mothers do not need to agree with their partner about the name for their baby. Babies are born and given the word without any other input from the father. This means that parents …

100 French Last Names For Baby

If you have been thinking about naming your baby but are stuck with what kind of name to choose, French last words might be perfect. We’ve compiled a list of French surnames and their meanings to browse through. This list will allow you to find the perfect last name for your baby boy or girl, …